The Experts Guide to Modern Candidate Nominations

Follow this guide to implement a successful candidate nominations process, while keeping things easy and convenient as possible. From obtaining candidate nomination applications to approval and reporting, we’ve developed a path to follow that ensures a smooth and transparent process.

This guide includes insights about the importance of members being able to choose from multiple candidates, digital governance best practices, and tips to recruit and quality candidates.

Creating an Awareness Plan

A vital element of any member organization is a dynamic, diverse, and engaged board with enthusiastic elected officials. As more board members retire or move on, your organization needs to have a robust nominations process to maintain diversity, equity and representation of current membership, embolden fresh ideas, and encourage competition.

Strategic Communications

Waiting until just ahead of an election is no way to recruit for open positions – recruitment is a year-round process. Throughout the year, communicate to members the importance of their service, what the role entails, and what the benefits are.

Communicate across all available channels and be sure to pay extra attention to your most engaged members throughout the process. Nurture the interest your most active members already have in your organization.

As convenient as it would be, sadly candidates rarely just magically appear. Because of this, your organization and board must approach people to convince them to serve. A vital first step in the process is to let your members know when you’ll start accepting nomination applications. Actively promote your nomination process and the qualifications you’re seeking at least six weeks before accepting applications. This provides members the opportunity to consider their nomination and gather all the necessary information.

Newsletter articles, social media posts, mailers, email reminders – does that sound like how you notify your organization’s members of a special event or promotion? It’s crucial you have a communication and promotions plan for your nominations process and the election as well.

If you can share a variety of election reminders with your members, they’ll be more likely to participate in the process. Here’s our recommended communications and promotions schedule starting at six weeks out from

accepting candidate nominations:

A Modern Nominations Process

Modernizing your election process is a common goal for many member organizations. It allows you to bring current-day convenience and security to a process that is central to how member organizations operate.

Filling Your Candidate Nominations Pipeline

It sounds obvious, but in order for elections to run the way they are supposed to, you need candidates running for the open positions. Many parts of the election are reliant on members who want to vote, and there is no better way to accomplish that than by convincing strong, qualified candidates to run. Uncontested elections see a significant dip in voter participation, as members can feel that their vote doesn’t matter in these instances.

Who Are Your Candidates, Really?

Help Your Voters Find Out!Simplify the Application Process

Each hoop candidates must jump through decreases the likelihood of receiving their nomination application. So how can you make the process easier for candidates? The most effective way is to have one efficient nominations platform online. This allows candidates to fill out and submit info anywhere at any time, and know their information is saved and secure.

With a online nomination software, the process of submitting a candidate application becomes significantly less intimidating and more appealing. Getting new candidates has never been simpler with the technology that is now available – make sure your organization is using it to its full advantage!

When candidates can self-register any time of day, it makes them much more likely to submit a nomination application. The easier the process the less likely you will lose potential candidates along the way.

A convenient electronic nominations platform not only makes things easier for potential candidates, but it can also reduce the workload for administrators. Removing the need to assist nominees through the process manually, which can add up to a great deal of time saved throughout the process.

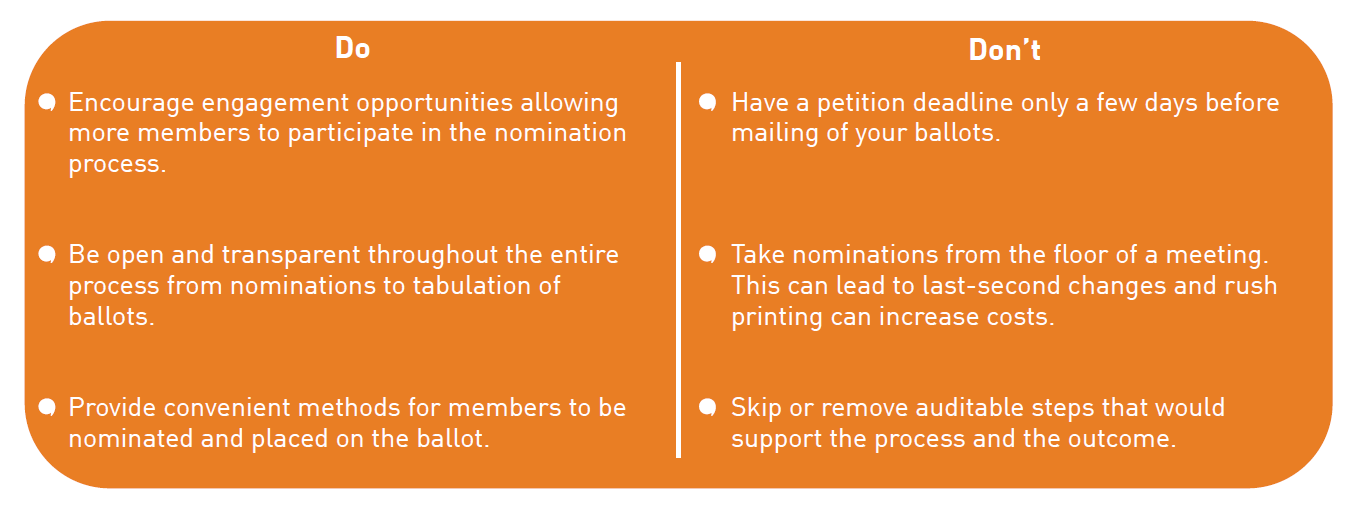

Modern Candidate Nominations Best Practices

Form a Nominating Committee

Your current board must be willing to approach potential candidates to ask them to serve. However, appointing a nominating committee to formally make the board nominations, accept petitions and help oversee the election can be extremely valuable. While it is the responsibility of the entire board to help recruit new members, the nominating committee should vet and select candidates then allow any additional candidates to come forward once the board slate has been announced.

Board diversity is imperative and many members are generally willing to step up and serve as long as they’re asked to do so. A strong formal nominations process can help organizations of every size grow and strengthen their boards and keep the organization healthy and evolving for many years to come.

Certified Candidate Nominations

Even if your organization experiences an uncontested election, there are still steps you can take to protect yourself from member complaints and doubt. While an uncontested election may not be a significant concern for every member, they’ll likely want to know that everything was handled properly. Were applications made readily available? Or were things kept relatively hidden to ensure an uncontested election? These are the questions you could receive from members, and you should be ready with answers.

All involved parties – members, staff, candidates, etc. – want to know that an uncontested election didn’t occur due to a lack of effort. You should be able to point to communications you’ve had with members that the nomination period was open, and highlight the opportunities that were available for submissions. If you can demonstrate everything was handled properly, it shows everyone involved that the results are legitimate.

In addition to simplifying the nomination process for administrators and candidates, our Nominations and Petitions software can provide a “certified uncontested” election report. A certified nominations report provided by an unbiased third-party, lends credibility to the process.

Providing certified, secure, and convenient nominations process for your board of directors is central to the governance of your organization. When you bring nominations, signature collection and communications with candidates online it will streamline all your organization’s priorities with ease.

Making the nomination process easier and more convenient will make a noticeable impact on your membership. Use all your communication channels to promote the importance of elections and running for leadership positions. Regularly send messaging highlighting the importance of their involvement in your organization’s governance activities.

Online nominations and petitions is an effective way to modernize the application process while making it easier for everyone involved. And receiving a certified nominations report from an unbiased third-party provides assurance the application process was completed fair and transparently.

Since joining SBS in 2011, Tony has led company communications, branding, and product launches, maintaining SBS as the go-to for governance solutions. He regularly hosts educational webinars and speaks at national trade association events across the United States. Tony’s expertise has earned him media recognition, with features in outlets like Rural Electric Magazine, The Association Adviser podcast, Associations Now, and NBC’s King 5 Mornings in Seattle.